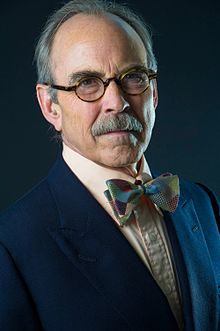

William Hall "Bill" Janeway (born May 3, 1943) is an American venture capitalist and economist. His work on the innovation economy emphasizes the strategic role played by the state and by financial speculators.

William Hall (Bill) Janeway | |

|---|---|

| |

| Born | May 3, 1943 New York City, United States |

| Alma mater | Princeton University Pembroke College, Cambridge |

| Occupation(s) | Venture capitalist Economist |

| Spouse | Weslie Janeway |

| Parent(s) | Elizabeth Hall Janeway Eliot Janeway |

| Family | Michael C. Janeway (brother) |

Early life and education

editBill Janeway was born on May 3, 1943, in Manhattan, the second son of Elizabeth Janeway, author and critic, and Eliot Janeway, political economy columnist. He attended Trinity School in New York, from which he graduated as valedictorian of the class of 1961, and Princeton University, from which he graduated as valedictorian of the class of 1965. He received a Marshall Scholarship to the University of Cambridge,[1] where he matriculated at Pembroke College and received a Ph.D. in economics in 1971.[2] His doctoral thesis, titled "The Economic Policies of the Labour Government of 1929-1931" was supervised by Professor Lord Kahn.[3]

Investment career

editInvestment banking

editIn 1970, Janeway joined F. Eberstadt & Co., Inc., the investment-banking firm that was founded by Ferdinand Eberstadt. In 1979, he was promoted to director of corporate finance. In 1985, F. Eberstadt was acquired by Robert Fleming & Co., the London merchant bank and investment management firm. Janeway served as director of corporate finance of the resulting American subsidiary, Eberstadt Fleming & Co., Inc., until 1988.[4]

Venture capital

editJaneway joined Warburg Pincus, the private equity firm, in 1988 as head of its high technology investment team.[4] The firm’s high-tech investments through the 1990s centered on information and communications technology, and, after 1991, increasingly focused on enterprise software.

In 1992, the firm funded the launch of OpenVision Technologies, which subsequently merged with VERITAS Software in 1996.[5] In 1999, Warburg Pincus also was the founder and sole investor in BEA Systems.[6] Warburg Pincus eventually distributed its positions in both companies to its limited partners, realizing total returns of $750 million in VERITAS shares and $6.5 billion in BEA shares on investments in each of approximately $50 million.[7]

In 2006, Janeway retired as Vice Chairman of Warburg Pincus. He remains a special limited partner.[4]

Research

editIn collaboration with Michael McKenzie of the University of Sydney, Janeway conducted research on venture capital returns.[8] He served as a teaching visitor at Princeton University’s economics department in 2012.

Work on innovation

editJaneway re-engaged with academic economics through his friendship with Hyman Minsky that began in the mid-1980s.[9] Janeway’s article, "Doing Capitalism: Notes on the Practice of Venture Capitalism," presented at the annual meeting of the Association for Evolutionary Economics in December 1985,[10] was written at Minsky’s behest.

Current positions

editJaneway is a special limited partner of Warburg Pincus. Janeway is a director of Magnet Systems and O'Reilly Media. He is an affiliated member of the faculty of economics at Cambridge University.[11]

Janeway is a co-founder and member of the board of governors of the Institute for New Economic Thinking. He is a member of the board of directors of the Social Science Research Council and of the Advisory Board of the Princeton Bendheim Center for Finance. He is a member of the management committee of the Cambridge-INET Institute, University of Cambridge and a member of the board of managers of the Cambridge Endowment for Research in Finance (CERF). He is a member of the board of directors of the Fields Institute for Research in the Mathematical Sciences. He is the author of Doing Capitalism in the Innovation Economy: Reconfiguring the Three-Player Game between Markets, Speculators, and the State, published by Cambridge University Press in 2012.

Philanthropic work

editJaneway and his wife, Weslie Janeway, established the Cambridge Endowment for Research in Finance in 2001[12][13] and funded the annual Princeton-Cambridge Finance Seminars in 2004.

Personal life

editIn 1985, Janeway married Weslie Resnick, a vice president of F. Eberstadt & Company, in a non-denominational ceremony in New York City. It was his second marriage.[14][15]

Honors

editIn September 2012, Janeway was awarded an honorary Commander of the Order of the British Empire (CBE) "for services to education in support of Cambridge University and to UK/US relations".[16] He is the recipient of the 2017 Marshall Medall of the Marshall Aid Commemoration Commission.[1]

Janeway's book Doing Capitalism was included in Foreign Affairs' 2012 list of "Best Books on Economic, Social, and Environmental Subjects", as well as the Financial Times' "Best books of 2012".[17][18]

Publications

edit- W. H. Janeway, Doing Capitalism in the Innovation Economy: Markets, Speculation and the State (Cambridge University Press, 2012; fully revised and updated version, Cambridge University Press, 2018)

- M. D. McKenzie, and Janeway, W. H., "Venture Capital Funds as an Alternative Class of Investment" in Asset Management: Tools and Strategies, June, (London: Bloomsbury Publishing Company, 2011)

- W. H. Janeway, "Doing Capitalism, revised and extended" in W. Drechsler, Kattel, R. and Reinert. E.S. (eds.), Techno-Economic Paradigms: Essays in Honour of Carlota Perez, (London: Anthem Press, 2009)

- W. H. Janeway, Introduction, in N. R. Lamoreaux and Sokoloff, K. L. (eds), Financing Innovation in the United States, 1870 to the present. (Cambridge MA: MIT Press, 2007)

- W. H. Janeway, "Technology and Value", Social Research. 64 (3) 1327-1331 (1997)

- W. H. Janeway, "The 1931 sterling crisis and the independence of the Bank of England", Journal of Post-Keynesian Economics. 18 (2) 251-268 (Winter 1995-1996)

References

edit- ^ a b "Marshall Aid Commemoration Commission Year ending 30 September 2017" (PDF). Marshall Aid Commemoration Commission. 2017. Retrieved 27 July 2020.

- ^ "Dr. William H. Janeway, Hon. CBE". Cambridge in America website: http://www.cantab.org/component/content/article/1673 (accessed 18 July 2018).

- ^ W. H. Janeway (1971). The economic policy of the second Labour government 1929-1931 (Unpublished) (Ph.D). University of Cambridge: British Library. Retrieved 29 October 2012.

- ^ a b c "People: William H. Janeway". Warburg Pincus. Retrieved 2012-10-11.

- ^ "William Janeway: Executive Profile & Biography - Businessweek". Investing.businessweek.com. Retrieved 2012-10-11.[dead link]

- ^ "BEA-Warburg Venture Formed". New York Times. 14 December 1999.

- ^ “Warburg Pincus Closes $5.3 Billion Global Private Equity Fund”

- ^ McKenzie, Michael D.; Janeway, William H. (1 September 2011). "Venture capital funds and the public equity market". Accounting & Finance. 51 (3): 764–786. doi:10.1111/j.1467-629X.2010.00373.x. S2CID 154090784.

- ^ "New Hope for Financial Economics: Interview with Bill Janeway | The Big Picture". Ritholtz.com. 2008-11-17. Retrieved 2012-10-11.

- ^ Janeway, William H. (June 1986). "Doing Capitalism: Notes on the Practice of Venture Capitalism". Journal of Economic Issues. 20 (2). Association for Evolutionary Economics: 431–441. doi:10.1080/00213624.1986.11504514. JSTOR 4225724. 4225724.

- ^ "Faculty of Economics, University of Cambridge". www.econ.cam.ac.uk. February 2017. Retrieved 2017-04-04.

- ^ "$10 million for financial research". University of Cambridge. 2001. Retrieved 16 October 2012.

- ^ "Janeways donate $10m to CERF". Financial Times. 2005.

- ^ "Weslie Resnick Weds W.H. Janeway". New York Times. June 30, 1985. Retrieved 28 November 2021.

- ^ Haskell, Meg (2014). "Weslie Resnick - Geneticist, Philanthropist". Search Magazine. Retrieved 28 November 2021.

- ^ "Cambridge author William H. Janeway awarded CBE by Her Majesty the Queen". Cambridge University Press. 2012. Retrieved 16 October 2012.

- ^ "Best Books on Economic, Social, and Environmental Subjects". Foreign Affairs. Retrieved 27 December 2012.

- ^ "Best books of 2012". Financial Times. 3 December 2012. Retrieved 3 December 2012.